is aclu a tax deductible charity

For more information see the ACLU website on this. ACLU monies fund our legislative lobbyingimportant work that.

Get Your Max Refund Today.

. The tax ID of the American Civil Liberties Union Foundation is 13-6213516. Now more than ever we need you by our side. Making a gift to the ACLU via a wire transfer allows you to have an immediate.

However some also receive funds from the national ACLU with the distribution and amount of such assistance varying from state to state. The main ACLU is a 501c4 which means donations made to it are not tax deductiblethough you do get a nifty membership card if you donate there. Make your tax-deductible gift today and help us fight alongside people whose rights are in severe jeopardy.

Gifts to the ACLU Foundation on the other hand are deductible because that arm of the organization engages solely in legal representation and communications efforts. The ACLU Foundation is a 501c3 nonprofit which means donations made to it are tax deductible. You can read all about it on this page of the ACLUs website.

In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the taxpayers adjusted gross income AGI. The ACLU Foundation of Maryland is a 501 c 3 charity which means that contributions are tax-deductible and cannot be used for political lobbying. The ACLU could be a 501c 4 nonprofit corporation but gifts to it are not tax-deductible.

To make a bequest that qualifies for a federal estate tax charitable deduction you may direct your gift to the ACLU Foundation as follows. It is the membership organization and you have to be a member to get your trusty ACLU card. CharityWatchs rating of the American Civil Liberties Union ACLU is for the 501c4 tax-exempt social welfare organization tax ID 13-3871360.

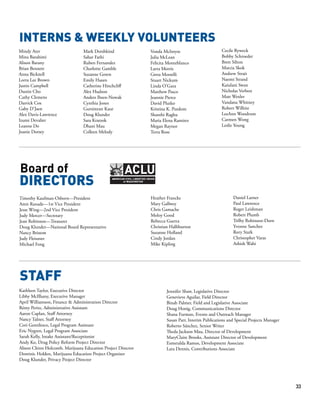

File Your Taxes Absolutely Free From Any Device. Dorothy M Ehrlich Deputy Executive Director ACLU 561188. Foundation gifts fund our litigation and public education efforts.

A donor who chooses to Join and become a card-carrying member of the ACLU is making a contribution to the American Civil Liberties Union. The ACLU is a 501 c 4 nonprofit corporation but gifts to it are not tax-deductible. The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. It is the membership organization and you have to be a member to get your trusty ACLU card. Yes Ive already included the ACLU in my estate plans.

The rating does not include the financial activities of the local ACLU affiliates or of the affiliated 501c3 public charity entity the ACLU Foundation tax ID 13-6213516CharityWatch issues a separate rating for the ACLU. ACLU monies fund our legislative lobbyingimportant work that. Make a Tax-Deductible Gift to the ACLU Foundation.

The American Civil Liberties Union ACLU is a 501 c 4 a tax -exempt social welfare organization that engages in political andor lobbying efforts to further its mission which means donations are treated as membership fees and are therefore not tax deductible. This is because donations in support of legislative advocacy supporting specific bills that enhance civil liberties protections or opposing bills that seek to erode them are not tax deductible. It is the enrollment organization and you have got to be a part to urge your trusty ACLU card.

Geri E Rozanski Director. Anthony D Romero Executive Director CEO ACLU 436653. The ACLU is accredited by the Better Business Bureau and the Charity Navigator has ranked the ACLU with a four-star rating.

The ACLU Foundation is a 501c 3 nonprofit corporation. Less American Civil Liberties Union Foundation is a 501 c 3 organization with an IRS ruling year of 1967 and donations are tax-deductible. The local affiliates solicit their own funding.

Is the ACLU an organization that falls under charitable donations. Donations to the ACLU are not tax-deductible because the organization engages in legislative lobbying. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross.

The ACLU is a 501 nonprofit corporation but gifts to it are not tax-deductible. See How Easy It Is With TurboTax. The ACLU Foundation preserves and promotes civil rights and liberties as guaranteed by the United States Constitution.

ACLU monies support our authoritative lobbyingimportant work that cannot be bolstered by tax-deductible reserves. We need you to help make that happen by rushing in a year-end gift to the ACLUs 2022 Action Fund before midnight on December 31. Over the past year the ACLU has fought against a resurgent wave of extremism in all 50 states.

Gifts to the Foundation fund our litigation communications advocacy and public education efforts in Maryland and across the country. ACLU monies fund our legislative lobbying--important work. The main ACLU is a 501c4 which means donations made to it are not tax deductiblethough.

It is the membership organization and you have to be a member to get your trusty ACLU card. A donor may make a tax-deductible gift only to the ACLU Foundation. How do I find my military contract.

The ACLU is a 501 c 4 nonprofit corporation but gifts to it are not tax-deductible. Membership dues and other gifts to the American Civil Liberties Union are not tax deductible. Qualified contributions are not subject to this limitation.

It is the membership organization and you have to be a member to get your trusty ACLU card. Contributions to the American Civil Liberties Union are not tax deductible. Donations to the ACLU are not tax deductible while donations the the ACLU Foundation are.

Gifts to the ACLUs Guardian of Liberty monthly giving program are not tax deductible. The ACLU is actually two very closely associated institutions the American Civil Liberties Union and the ACLU Foundation. How much does Anthony Romero make.

American Civil Liberties Union Real Life Heroes Wiki Fandom

Fuel Our 2022 Action Fund American Civil Liberties Union

Support The Aclu Foundation Of Virginia American Civil Liberties Union

Donate To The Aclu Of Florida Aclu Of Florida We Defend The Civil Rights And Civil Liberties Of All People In Florida By Working Through The Legislature The Courts And

Aclu Donations How To Make A Tax Deductible Gift Money

Fund The Fight Support The Aclu Of Massachusetts American Civil Liberties Union

Update Your Monthly Commitment To The Aclu American Civil Liberties Union

Aclu Of Virginia Home Facebook

Ways To Give Aclu Of Washington

Spotlight On American Civil Liberties Union Charitocracy

American Civil Liberties Union Foundation Scholarships And Internships Wemakescholars

Aclu Applauds Closing Of Death Row In Oregon Aclu Of Oregon

Pin By Wan M On Politics History Current Events Global Dod In 2021 Family Separation Supportive Make A Donation